Development of Household Care Chemical Industry in Pakistan

Kashif Hussain Mangi, Zubair Ahmed Chandio

Department of Chemical Engineering, QUEST Nawabshah, Pakistan

Fareed Hussain Mangi

Department of Energy & Environment Engineering, QUEST Nawabshah, Pakistan

Overview

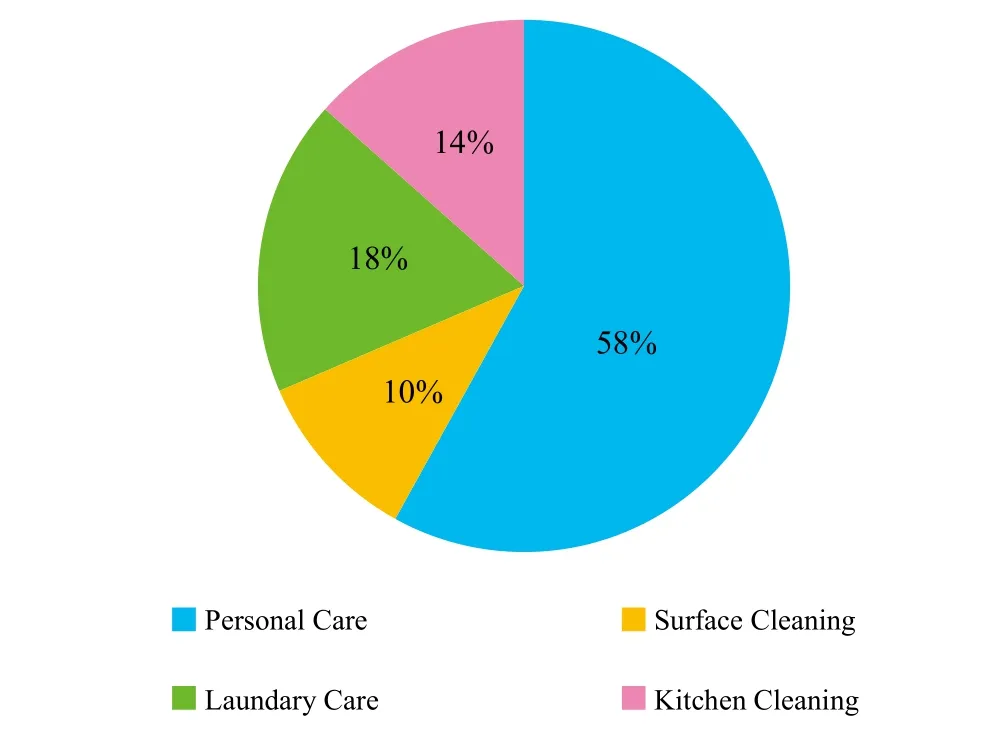

The household care chemical industry in Pakistan is very assorted with wide ranging home and personal care (HPC)products and commercial producers. Currently, Proctor &Gamble, Unilever, and Colgate Palmolive Pakistan are major contributors in this industry.[1]All major brands of these companies are available in Pakistan. A break up of HPC categories is given the Figure 1.

Figure 1. Break up of consumption of household care products in Pakistan

International brands preferred by consumers

Essential market share of country is dominated by major multinational producers in all categories of home care.Pakistan market share situation is similar to world for HPC famous brands due to strict following of quality and frequent availability, which has maintained their prominent place at major cities of Country.[2]Whereas multinationals use their resources to make a strong impression on consumer consciousness, for example through advertising, local brands tend to have more limited visibility.[2]In view of the current high rate of inflation and the slowdown in the economy, a considerable proportion of consumers might be inclined to rethink their choice of home care product and shift to cheaper alternatives.

Soaps

Soap industry in Pakistan produces approximately 75,000 metric tons of toilet soaps. Composition of soap is generally 80% fats and oil. Major raw material inputs include Tallow and Palm oil. The soap market in Pakistan increased at a compound annual growth rate of 1.4% between 2004 and 2009.[3]The bar soap segment led the soap market in Pakistan in 2009, with a share of 97.8%.[4]The leading player in soap market in Pakistan is Unilever. Soap Market in Pakistan is a comprehensive resource for market/company shares.

Laundry

Laundry care products continue to dominate the household care environment accounting for 65% of the total sales volume.Despite the low purchasing power of Pakistani consumers,MNC’s dominate sales in the household care market due to absence of low cost competitors.[5]The MNC’s have the advantage of higher quality goods, lack of local competition and heavy advertising and promotional campaigns. According to the management, detergent penetration is very low in Pakistan.[3]About 50% of the population uses laundry soap for fabric wash. Similarly, shampoo penetration is one of the lowest in Asia.[6]Hence, tremendous untapped potential exists in the detergent and shampoo market.

P&G is constantly reformulating its products to fit the needs of the local consumer. It pioneered the introduction of small sachets for various consumer products, including Ariel so that the price would not burden people in the rural areas. Colgate- Palmolive introduced Brite in 1981 and a new improved version in 2004 especially formulated with stain removal and dirt cleaning action. Surf Excel is the oldest detergent brand to be present in Pakistan since 1960.[7]

The laundry care market has evolved over time. These changes have led to intensified competition among rival producers and gradual expansion in consumer choice. The market currently faces strategic challenges from changes in consumer needs and preferences as well as any future rise in outsourcing and use of multi-purpose launderettes and from emerging washing technologies.[2,4]

UK consumers use washing machines most frequently each week although Pakistan consumers wash their clothes more frequently overall with a combination of machine and hand washing. Food and cooking are the most common causes of clothes staining and odor tainting for most consumers.[8,10]

For many centuries, soap was primarily used for laundering. However, laundry detergents have essentially replaced soap because they perform over a broad range of water hardness levels. Laundry Detergent and washing powders have become an important part of every consumer’s life. The market offers a variety of washing powders, each brand claiming to wash the cleanest at unbeatable prices to consumers.[10]Laundry detergent, however, exerts a hidden but taxing cost on the environment and consumer health due to their environment-damaging properties. Phosphates are one of the main ingredients in most present-day laundry detergent and are also the primary culprits in polluting water bodies.[9]

Since the last two years, the market trend (Pakistan) in the laundry detergents has taken a good pace, and many consumers are switching from bar soap to laundry detergent.In terms of percentage, the increase ratio is about to 20%-25%per annum. Increased competition in some categories has led to an increase in the variety of products which constitute particular ranges. Overall, competitive pressure stemming from increased prices and the eあects of the economic recession led to some companies taking proactive measures during 2009 in order to gain value share by expanding into unexploited categories of home care and seeking to differentiate their products among consumers.[8,10]

Detergent

Market share plays a prominent role in business research standing in the market. There are many competitors of detergent in Pakistan. Some of the leading brands are given.Take Surf Excel for an example. It was the first in the Pakistan detergent powder market. Over the years, Surf Excel has anticipated the changing washing needs of the Pakistan homemaker and constantly upgraded itself. Surf Excel is Pakistan’s largest selling compact detergent powder.[5]

Detergent market demand is 230,000-240,000 tons.The local detergent industry is producing around 175,000 tons.[2,7]

There is demand-supply gap of about 55,000 tons. Laundry Detergent Powder (LDP), as its market stands at 240,000 tons annual with a growth almost 10 percent a year.

Detergent market is growing by 10-12%. The quality conscious upper class consumers choose quality detergent products. Nowadays, more population in Pakistan is urbanizing, hence more people tend to buy HPC products; as a result of it demand of HPC products is projected to increase.[8]

Advertising has played a considerable role in shaping and changing the perception of people in preferring detergent over soap, increasing awareness of usage benefit of detergent and nowadays consumer choose detergent over soap due to odor and gluiness resulting from soap use(Table 1, Table 2).[9]

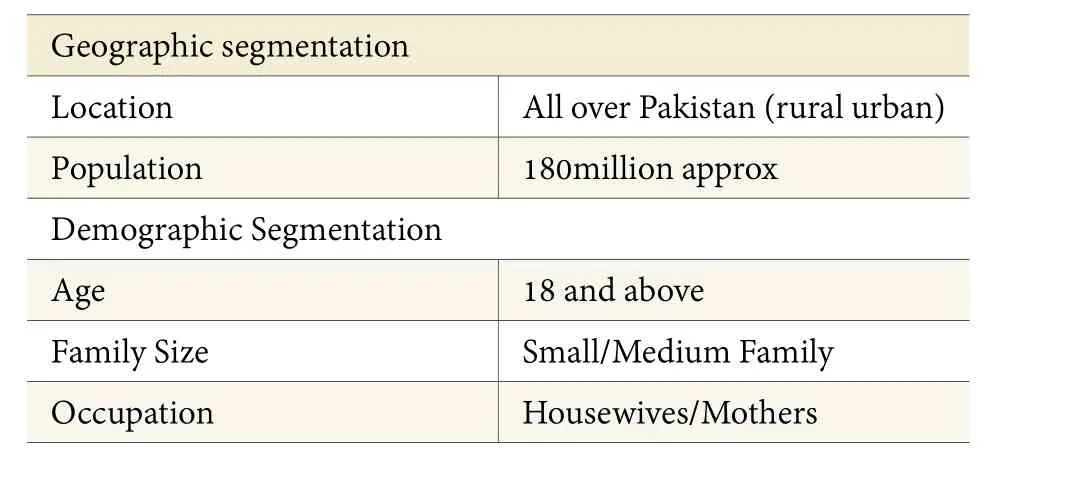

Table 1. Target market

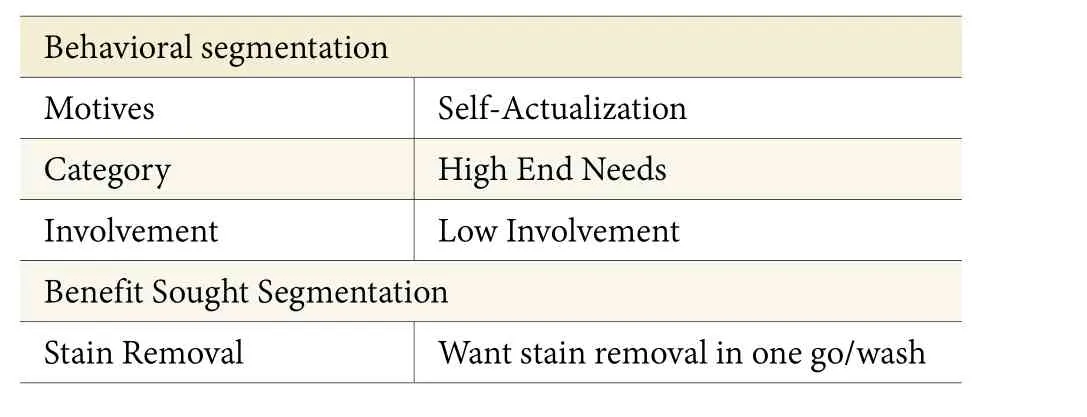

Table 2. Behavioral segmentation

Issues in HPC sector in Pakistan

The ingress of cheaper and tax evaded goods traきcked through illegal channels increased over the years has posed a serious challenge to MNC, HPC companies in Pakistan. On the other hand, the legal import of cheaper bar soap from Indonesia has become a major concern among international and local companies in recent years.The low cost of these goods and higher trade margins attracts both consumers and retailers. As a result, the volumes and margins of FMCG players in the market have been tremendously aあected.[5,10]

HPC chemicals industry is witnessing a growing phase in Pakistan. The recent plunge in oil prices has significantly aided to the profit margins of the major companies, because of decrease in per unit energy cost.Consumer on the hand, has not been a beneficiary of the decreased energy cost. The reason is that the companies have not cut their consumer product prices. Despite, the consumer demand of HPC products is on rise.[8]

Both local and international companies import their raw material for HPC products from abroad. So the Pakistani rupee depreciation has become one of the major concerns for companies, both local and international.[7]

Future prospects

An increase in urbanization and awareness of the populace has resulted in surge of favourable value and volume growth of beauty and personal care products. The style and personality conscious urban people look for personal care and beauty products to enhance their looks and beauty. So, the people are ready to pay lavishly for beauty and personal care products.[5]

In Pakistan, a significant growth in household care products can be expected in the near future. The reasons attributed to this, including rapid increase in population, urbanization of populace in search of employment, rising incomes,improvements in living standards and increased awareness of health and hygiene. In addition, a better distribution network with the opening of larger urban supermarkets will fuel it.[8,10]

The growing penetration of smart phone, mobile networking and electronic media in both rural and urban areas has aided to growth in HPC chemicals. The growth is directly related to the extent of awareness, brand activation and education delivered by brands to their consumers.Companies have made a heavy amount of investments in educating consumers regarding hygiene and personal development through electronic media.[9]

Introduction and growth of hypermarkets is seen in recent times. A number of multinational operators have stepped in Pakistani supermarkets. They are continuously expanding their outlets and stores. Consumers have generally a welcoming attitude towards the hypermarkets,specifically those urban masses which prefer these shopping channels.[11]Consumers in Pakistan have now started the trend of stocking up of items and products during periodic big shopping trips. This trend can be attributed to the greater need for buying products in bulk at discounted in the hypermarkets. After meeting with success in Pakistan’s biggest cities Lahore and Karachi, the impact of the increasing presence of these channels is now being felt in smaller cities such as Rawalpindi, Islamabad and Faisalabad.

Although the global economy is in recovery phase now, but the Pakistani economy is still fragile and volatile.Sustaining the inflationary stress remains there.[1,4]Nevertheless, volumes will continue to grow at a medium pace due to the nature of consumer demand for many of the products.[4]However, any possible deterioration in economic conditions or delay in the expected economic recovery will end up causing negative volume growth and very minute unit price increases as more consumers shift to economy brands from their current choice of standard brands.[7]Even if the economic recovery begins soon, high inflation will still ensure that the magnitude of the increase will be much smaller and less significant in real terms compared to nominal growth.[4]

Recommendations

New market research can be conducted to predict the consumer spending trends in Pakistan. It can give insight into future investment possibilities. New and innovative products can be introduced which can attract the masses. The new products can be based on local consumer preferences.

Economic data comparison can be done for regional and national companies.

Future plans and demand trends can be predicted through gaining insight into the consumer preferences and changing behaviors that will aあect the strategic direction of the HPC chemical market. Explore in-depth analysis of new products launched globally and action points that highlight existing best practice and new innovations.

[1] Sectoral Analysis for Pakistan-India Trade Normalization,PITAD 2012.

[2] Pakistan: Country Gender Profile Study.

[3] Future Scenarios of Pakistan-India Relations, 2015.

[4] Pakistan Economic Survey 2014, 15.

[5] Pakistan National Economic & Environmental Development Study (NEEDS) by Malik Amin Aslam Khan.

[6] Development of Surfactants and Builders in Detergent Formulations YU Yangxin et.al. 2008.

[7] Pakistan P&G Annual Report 2014.

[8] Trade Development Authority of Pakistan; A Report on“TALC” Soap Stone 2009, 10.

[9] Pakistan Standard Industrial Classification PSIC Rev. 4 (2010).

[10] UNIDO-Industrial Policy and Environment in Pakistan 2000.

[11] Beauty and Personal Care in Pakistan: An overview by Euro monitor 2014, 15.

China Detergent & Cosmetics2016年2期

China Detergent & Cosmetics2016年2期

- China Detergent & Cosmetics的其它文章

- Synthesis of Monoglycerides with Cinnamomum Burmannii Seeds Oil and Its Application in Moisturizing Cream

- New Application of a Series of Preservatives Derived from Amino Acid for Cosmetic Products

- Cosmetic Safety Evaluation Based on In Vitro Three-dimensional Reconstructed Human Epidermis(3D-RHE) Models

- Problems and Suggestions for Domestic Non-special Use Cosmetics Record Filing in China

- Patent Protection of Daily Chemical Industry in China

- New Trends of Comsmetic Regulations in China