Analysis of China's Sulfuric Acid Market in 2010 and Outlook on 2011

Analysis of China's Sulfuric Acid Market in 2010 and Outlook on 2011

In 2010 the sulfuric acid market presented a relatively stable performance,with the price level stronger than that of the same period last year.China's sulfuric acid price showed a slight increase in the first quarter.Contrary to the overseas market,the price dropped in the second quarter.In the third quarter the price rose significantly,reaching the highest level of the year.However,the price declined at the end of the fourth quarter.

With regard to supply and demand,China's sulfuric acid output continued to rise sharply in 2010.In terms of foreign trade,its import volume showed considerable decrease compared with the same period last year,while its export volume showed considerable increase.

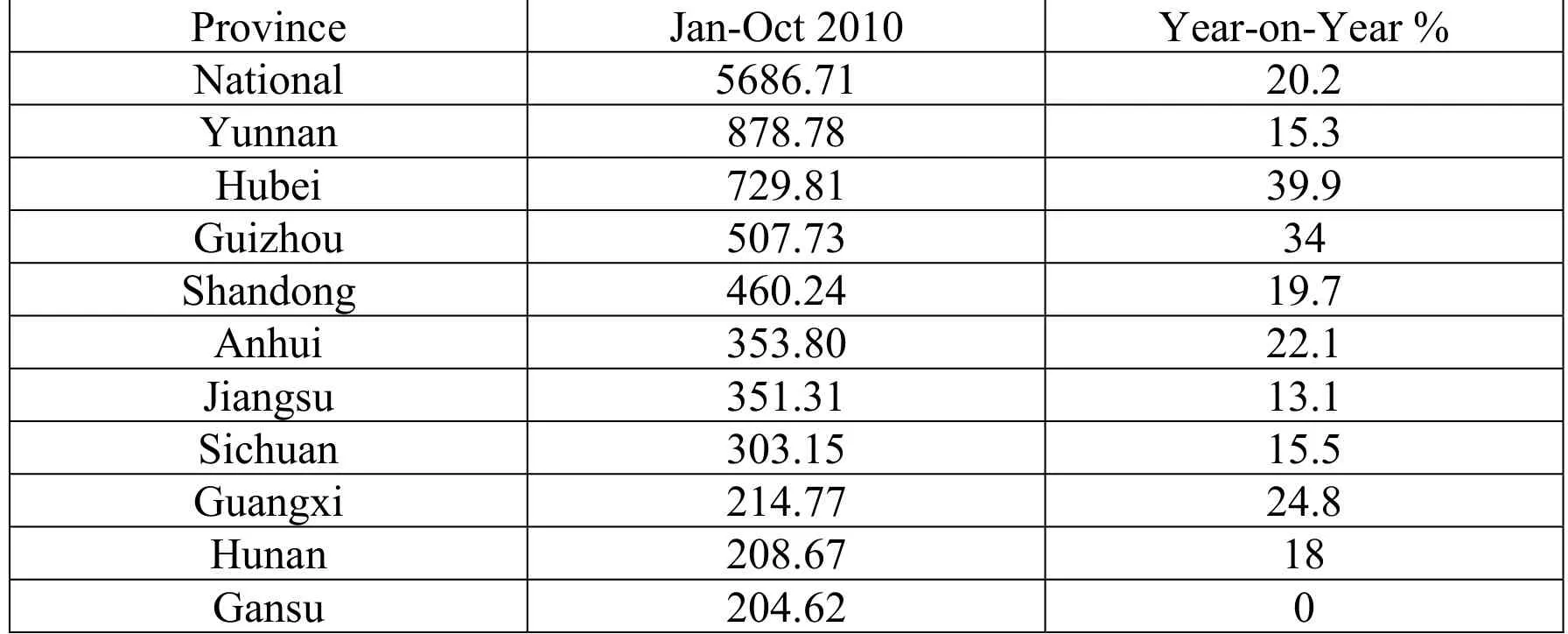

According to data from the National Bureau of Statistics,in 2010 China's total output of sulfuric acid is approximately 70.6 million tons,up by 18.5% on a year-on-year basis.The top ranking ten provinces are Yunnan,Hubei,Guizhou,Shandong,Anhui,etc.Between January and October,total output of the top ten provinces reached 4.213 million tons,accounting for 74.1% of total production nationwide.

Table 1 Top ten ranking provinces in sulfuric acid production in China between January and October 2010 (Unit: 10,000 t)

Despite a fast rise of sulfur output in 2010,China lacks sulfur resources,with the selfsufficiency rate still below 30%.The majority of its demand still depends on import.

In 2010,China imported a total of 10.4975 million tons of sulfur,while the figure of the same period last year was 12.1705 million,down by 13.75 % on a year-on-year basis.The key reason of the decreased import is sharp rise in overseas sulfur price,sluggish downstream demand due to climate disaster,and the drop in demand for raw material due to stock clearance by enterprises in China.Imported sulfur mainly comes from Saudi Arabia,Canada,Kazakhstan,Japan and Qatar,accounting for 71.2% of total import volume.

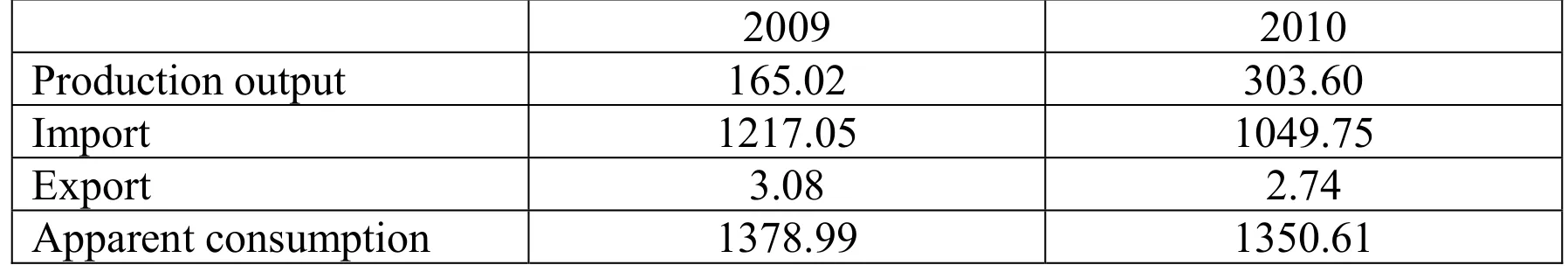

In 2010,China produced a total of 3.036 million tons of sulfur,while the figure of the same period last year was 1.6502 million,up by a hefty 83.98% on a year-on-year basis.The increase in output is mainly due to the start of production by Puguang Gas Field located in Dazhou,Sichuan,leading to a sharp increase in by-product sulfur.In terms of the output distribution,the production sites are mainly concentrated in Southwest,East China and Shandong,which account for about 66% of the national total production output.In terms of key sulfur manufacturers,the top 5 manufacturers with the highest output volume are Puguang Gas Field,Zhenhai Refining & Chemical,Jinlin Petrochemical,Fujian Refining & Chemical,and Qingdao Refining & Chemical respectively,which account for nearly one third of national total production output.

In 2010,China's sulfur price presented a wavelike fluctuation pattern.At the beginning of the year,the price rose along with the continual increase in international sulfur price.At the end of the second quarter,the prices started to decline,which dropped to the lowest point in August.In the fourth quarter,the price rose steadily.In 2010 the average annual unit price of imported sulfur is 127 USD/t,up by a sharp 117.87% YoY.

Table 2 Supply and Demand of Sulfur in China in 2010 (Unit: 10,000 t)

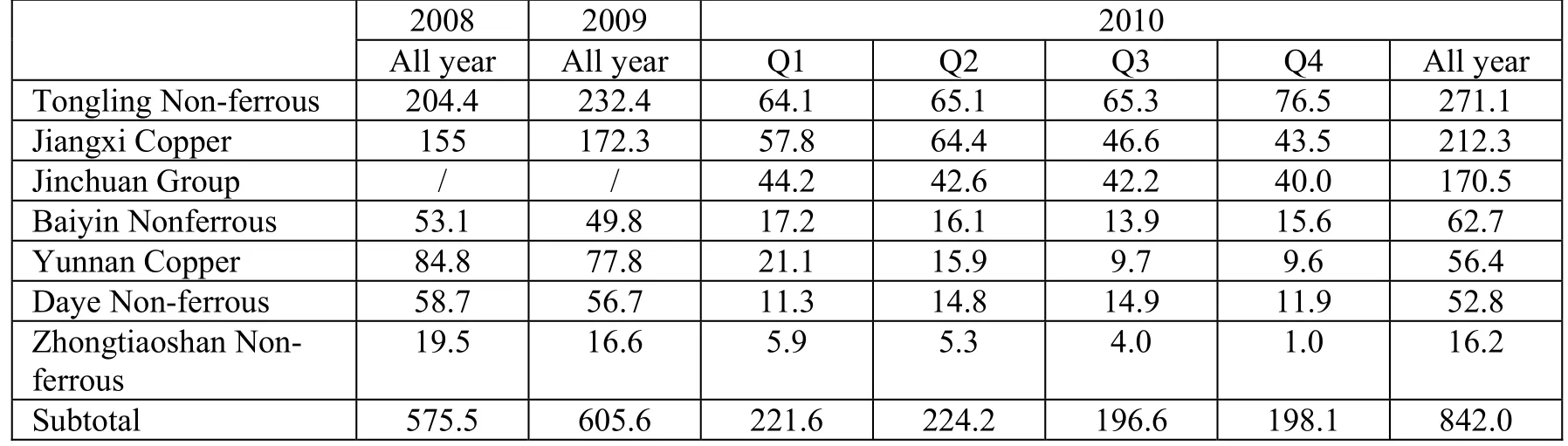

In 2010,the sulfuric acid output of seven major copper smelting enterprises reached 8.42 million tons (see Table 2).Judging from individual enterprises,the production of Tongling Nonferrous,Jiangxi Copper,Jinchuan Group,and Baiyin Company showed increase compared with that in the previous year.In particular,Tongling Non-ferrous and Jiangxi Copper showed evident growth.On the other hand,the sulfuric acid output of Yunnan Copper,Daye Non-ferrous and Zhongtiaoshan Non-ferrous declined,especially Yunnan Copper,which showed evident decrease in output.Pyrite ore is also one of the three key raw materials for sulfuric acid production in China.In 2010,China's pyrite ore production output totaled 15.128 million tons,up by 21.2% on a year-on-year basis,while the figure of the same period last year was 12.4794 million tons.Judging from the regional distribution of output volume,the top 5 provinces in terms of production output are: Guangdong with 380,000 tons,Anhui with 158,000 tons,Jiangxi with 151,000 tons,Sichuan with 150,000 tons,Yunnan with 149,000 tons.

Table 3 Sulfuric Acid Output of Major Smelting Manufacturers Adopting Fume Method for Acid-making (10,000 t)

4.Foreign trade of sulfuric acid

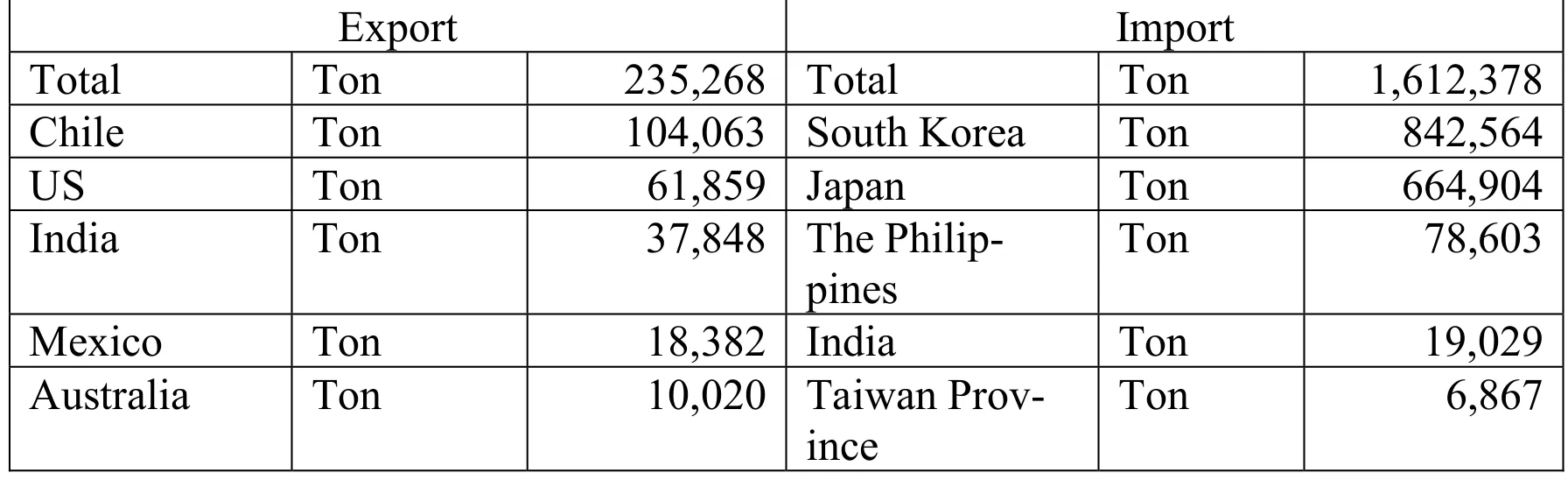

In 2010 the foreign trade pattern of China's sulfuric acid product experienced obvious changes,with evident decrease in import volume and significant increase in export volume.Throughout the year,the sulfuric acid import volume was 1.6124 million tons,down by 43%compared to the 2.83 million in 2009.The export volume was 235,000 tons,a huge rise compared to the merely 3041 tons in 2009.

In terms of imported countries,South Korea and Japan are still the largest source countries.In 2010 the total volume of sulfuric acid imported from these two countries reached 1.5075 million tons,accounting for 93.5% of total import.In terms of the form of trade,in 2010 the general trade import volume totaled 1.5981 million tons,accounting for 99.12% of total import volume.

In terms of exported countries,Chile,US,India,Mexico,and Australia are the major export destinations.In 2010 the total export volume reached 232,200 tons,accounting for 98.68%of total export.In terms of the form of trade,China's sulfuric acid export is all general trade export.

Table 4 Import/Export of Sulfuric Acid by Country in 2010

The sulfuric acid needed by China's fertilizer(phosphate fertilizer) industry accounts for approximately over 70% of the total sulfuric acid consumption volume,the remaining of which is used in other sectors such as rare earth,electrolytic manganese and titanium dioxide.Therefore,the trend of sulfuric acid market is mainly determined by the demand for fertilizer (phosphate fertilizer).The phosphate fertilizer mentioned here mainly refers to Diammonium Phosphate (DAP),Monoammonium Phosphate(MAP) and compound fertilizer.The phosphoric acid content in DAP is approximately 64%,and about 55% in MAP.The production of China's phosphate fertilizer is indicated by 100% phosphoric acid content.

According to data published by National Bureau of Statistics,in 2010 China's phosphate fertilizer output (converted into 100% phosphoric acid) totaled 17.01 million tons,up by 20.2% on a year-on-year basis.Among phosphate fertilizer varieties,DAP has a relatively high phosphoric acid content and therefore consumes a great amount of acid.According to relevant data from China Phosphorus and Sulfur Association,the sulfuric acid consumption of high concentration phosphorus compound fertilizer (DAP and MAP) accounts for 60-70%of total sulfuric consumption in the fertilizer industry.Furthermore,DAP is also the main product type of China's fertilizer exportation.

According to data from China Custom,in 2010 China exported a total of 3.988 million tons of DAP,up by 92.4% on a year-on-year basis.

China's DAP production capacity and output have reached serious surplus,and has to rely on export to balance it.However,as phosphate fertilizer is also a kind of resource product,the state government has imposed severe export policy on its export.In 2010,extra export tariff was imposed on DAP export between February and May,between September 1st and October 15th,and also in December,equivalent to up to 110% of export tariff.As a result,China's export volume is closely related to the tariff executed.

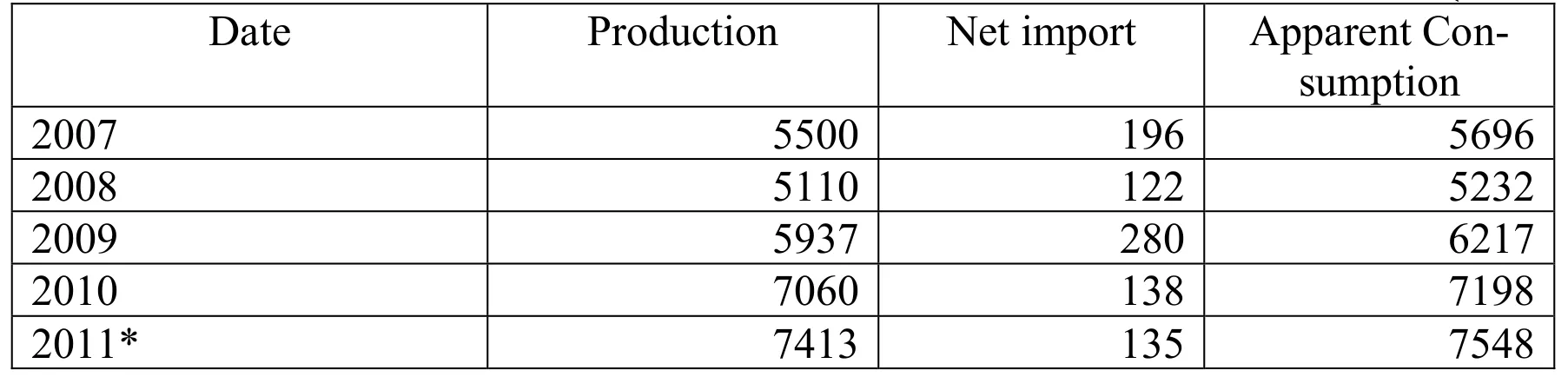

Table 5 Estimate of China's production and consumption of sulfuric acid (Unit: 10,000 t)

In 2011,judging from the perspective of supply,domestic sulfur output continued to increase.Port stock remains at a high level,but it still relies on import.At present China's annual production capacity of sulfur has reached above 5.5 million tons.Due to impact from raw materials and the rate of operation,the actual annual production volume is less than 3.5 million tons.In 2011,with the increase in the processing of high-sulfur crude oil in China,the operation startup of natural gas desulfurization projects as well as the increase in newly launched oil refining projects,China's petrochemical industry will supply more sulfuric acid to the market.More newly added production capacity will come from the development of high-sulfur gas fields.Sinopec Sichuan Natural Gas and PetroChina factories will become super large sulfur suppliers.It is expected that after its startup of production,Sichuan area will come to possess a sulfur supply ability of over 4.5 million t/a.In 2011 China's sulfur production output will approach 4 million tons,and the import volume will still hover around 10 million tons.There

fore,there will be a surplus in the supply of sulfur,the key ingredient of sulfuric acid.

In the aspect of consumption,the consumption of phosphate compound fertilizer and other industrial use acids will continue to grow.However,the fertilizer industry will still face serious surplus in production capacity,and increasingly unfavorable export policy.With the development in national economy,the demand for sulfuric acid by China's agriculture and other acid-using industries will continue to grow.Since phosphate fertilizer is the key acidconsumption industry,its consumption volume will directly affect sulfuric acid consumption volume.China is now facing serious surplus in phosphate production capacity.In 2011 the government's export tariff policy will become even more severe,which will bring adverse impact on the consumption of sulfuric acid.

Looking ahead into 2011,the prospect of China's sulfuric acid market is hardly optimistic.Firstly,the supply surplus will increase.With the sharp growth in sulfuric acid production with sulfur as raw material and from smelting industry through fume acid-making method,sulfuric acid output will continue to grow.Secondly,the state government will intensify efforts in restricting the export of resource type products.In 2011 the off-season tariff period for phosphate compound fertilizer will be shortened by 1.5 to 3 months compared to that in 2010,making it unfavorable to China's export of phosphate fertilizer.Furthermore,the rise in the price of crude oil on the international market will drive up the price of sulfur,which will then bring price hike in sulfuric acid,thus bringing favorable impact on China's sulfuric acid price.As such,there will be great pressure to drive up the price of sulfuric acid in the future.The export volume of phosphate fertilizer will directly determine the trend of China’s sulfuric acid price.It is therefore estimated that in 2011 the average price of China's sulfuric acid will be kept between 400-500 yuan/ton.

China Nonferrous Metals Monthly2011年4期

China Nonferrous Metals Monthly2011年4期

- China Nonferrous Metals Monthly的其它文章

- China's Major Non-ferrous Metals Imports & Exports

- Magnesium Production by Province in 2011

- Alumina Production by Province in 2011

- Aluminium Production by Province or City in 2011

- Refined Copper Production by Province or City in 2011

- Zinc Production by Province in 2011